If clients have mentioned struggling with or disliking your payment system, it may be time to add another payment option. We start by replacing the company’s “first period” of receivables with the January 1 data and “last period” with the information for December 31. Then we add them together and divide by two, giving us $35,000 as the average accounts receivable. Because of decreasing sales, Tara decided to extend credit sales to all her customers.

Usefulness of the Accounts Receivables Turnover Ratio

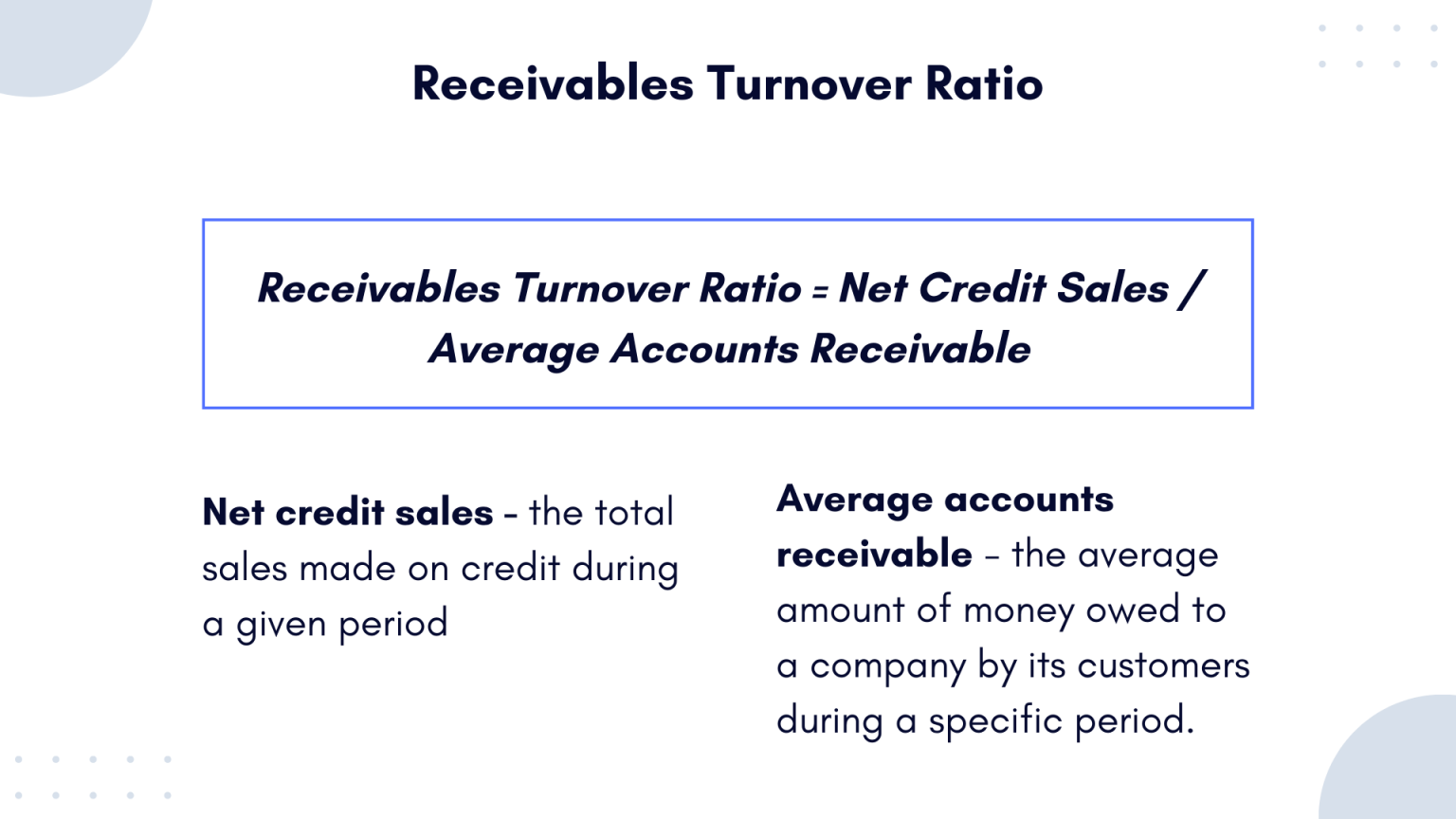

To find their average accounts receivable, they used the average accounts receivable formula. First, you’ll need to find your net credit sales or all the sales customers made on credit. Every business sells a product and/or service that must be invoiced and collected on, according to the terms set forth in the sale. There’s a right way and a wrong way to do it and the more time spent as a “lender”, the more likely you are to incur bad debt. And create records for each of your suppliers to keep track of billing dates, amounts due, and payment due dates.

What Is Asset Turnover Ratio and How Is It Calculated?

Lenient credit policies can result in bad debt, cash flow challenges, and a low turnover ratio. Efficiency ratios measure a business’s ability to manage assets and liabilities in the short term. Other examples of efficiency ratios include the inventory turnover ratio and asset turnover ratio.

Ask a Financial Professional Any Question

Ensure you have clear policies that maintain accuracy of the information on invoices, and procedures that send out invoices in a timely manner. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Ask Any Financial Question

If you own one of these businesses, your idea of “high” or “low” ratios will be vastly different from that of the construction business owner. By monitoring this ratio from one accounting period to the next, you can predict how much working capital you’ll have on hand and protect your business from bad debt. However, this should not discourage businesses as there are several ways to increase the receivable turnover ratio that will eventually help them improve revenue generation. This way you will decrease the number of outstanding invoices in your books resulting in an increased receivable turnover ratio. In the fiscal year ending December 31, 2020, the shop recorded gross credit sales of $10,000 and returns amounting to $500. Beginning and ending accounts receivable for the same year were $3,000 and $1,000, respectively.

Generally, a higher receivables turnover ratio indicates that the receivables are highly liquid and are being collected promptly. A low turnover ratio may also be caused by the entity’s own inabilities, like following an inappropriate credit policy or having defects in its collection process etc. Now we can use this ratio to calculate Maria’s average collection period ratio which would reveal the average number of days the company takes to collect a credit sale. We can do so by dividing the number of days in a year by the receivables turnover ratio. Lastly, when it comes to comparing different companies’ accounts receivables turnover rates, only those companies who are in the same industry and have similar business models should be compared.

Unpaid invoices can negatively affect the end-of-year revenue statements and scare away potential lenders and investors. A higher ratio shows you’re doing a better job at converting credit sales into cash. Your receivables turnover ratio can give insight into your AR whether your practices are leading to a healthier cash flow. The accounts receivable turnover ratio represents the number of times a company’s accounts receivable has been collected in a specific time period. Receivables turnover ratio is more useful when used in conjunction with short term solvency ratios like current ratio and quick ratio. These short term solvency indicators measure the liquidity position of the entity as a whole and receivables turnover ratio measure the liquidity of accounts receivable as an individual current asset.

A high ratio means a company is doing better job at converting credit sales to cash. However, it is important to understand that factors influencing the ratio such as inconsistent accounts receivable balances may inadvertently impact the calculation of the ratio. The receivable turnover ratio, otherwise known as debtor’s turnover ratio, is a measure of how quickly a company collects its outstanding accounts receivables. The ratio shows how many times during the period, sales were collected by a business. The receivable turnover ratio is used to measure the financial performance and efficiency of accounts receivables management.

These fields rely heavily on infastructure and machinery, which can slow down asset turnover. Tracking your accounts receivable ratios over time is crucial to your business. If it dips too low, that is an indication that you need to tighten your credit policies and increase collection efforts. If absorption costing vs variable costing: what’s the difference it swings too high, you may be too aggressive on credit policies and collections and be curbing your sales unnecessarily. To determine the average number of days it took to get invoices paid, you must divide the number of days per year, 365, by the accounts receivable turnover ratio of 11.4.

- No single rule of thumb exists to interpret receivables turnover ratio for all companies.

- When making comparisons, it’s ideal to look at businesses that have similar business models.

- The accounts receivable turnover ratio, or “receivables turnover”, measures the efficiency at which a company can collect its outstanding receivables from customers.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

Your accounts receivable turnover ratio measures your company’s ability to issue a credit to customers and collect funds on time. Tracking this ratio can help you determine if you need to improve your credit policies or collection processes. Additionally, when you know how quickly, on average, customers are paying their debts, you can more accurately predict cash flow trends. And if you apply for a small business loan, your lender may ask to see your accounts receivable turnover ratio to determine if you qualify. Your accounts receivable turnover ratio measures your company’s ability to issue credit to customers and collect funds on time.

The accounts receivable turnover or debtor’s turnover ratio is a measure of maintaining accounts which clarifies an organization’s efficiency in providing debt and collecting those debts. Company A’s accounts receivables turnover ratio would be 7.4, which would be considered a high ratio, depending on the industry. In denominator part of the formula, the average receivables are equal to opening receivables balance plus closing receivables balance divided by two. If the opening balance is not given in the question, the closing balance should be used as denominator.